What to do with over collected taxes

When a business over-collects sales tax, they must follow these steps:

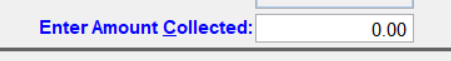

Report the over-collection: The business must report the full amount of sales tax collected, including the over-collected amount, in the designated box on their tax return. This over-collected amount is referred to as "Excess Tax Collected."

Remit the full amount to the Georgia Department of Revenue (GA DOR): It is mandatory for the business to remit the entire amount of sales tax collected, including the over-collected portion, to the GA DOR. Failure to remit collected sales tax is considered a felony.

Receive Vendor's Compensation: The business will be entitled to receive Vendor's Compensation for the full amount of sales tax remitted, including the Excess Tax Collected portion.

It is important to note that it is not uncommon for businesses to occasionally over-collect sales tax during certain periods. As long as the business reports the over-collection and remits the full amount to the GA DOR, it will not be considered a problem. However, if a business over-collects sales tax and fails to remit the money, keeping it for themselves, it is considered a crime.