Delete a property return

Edited

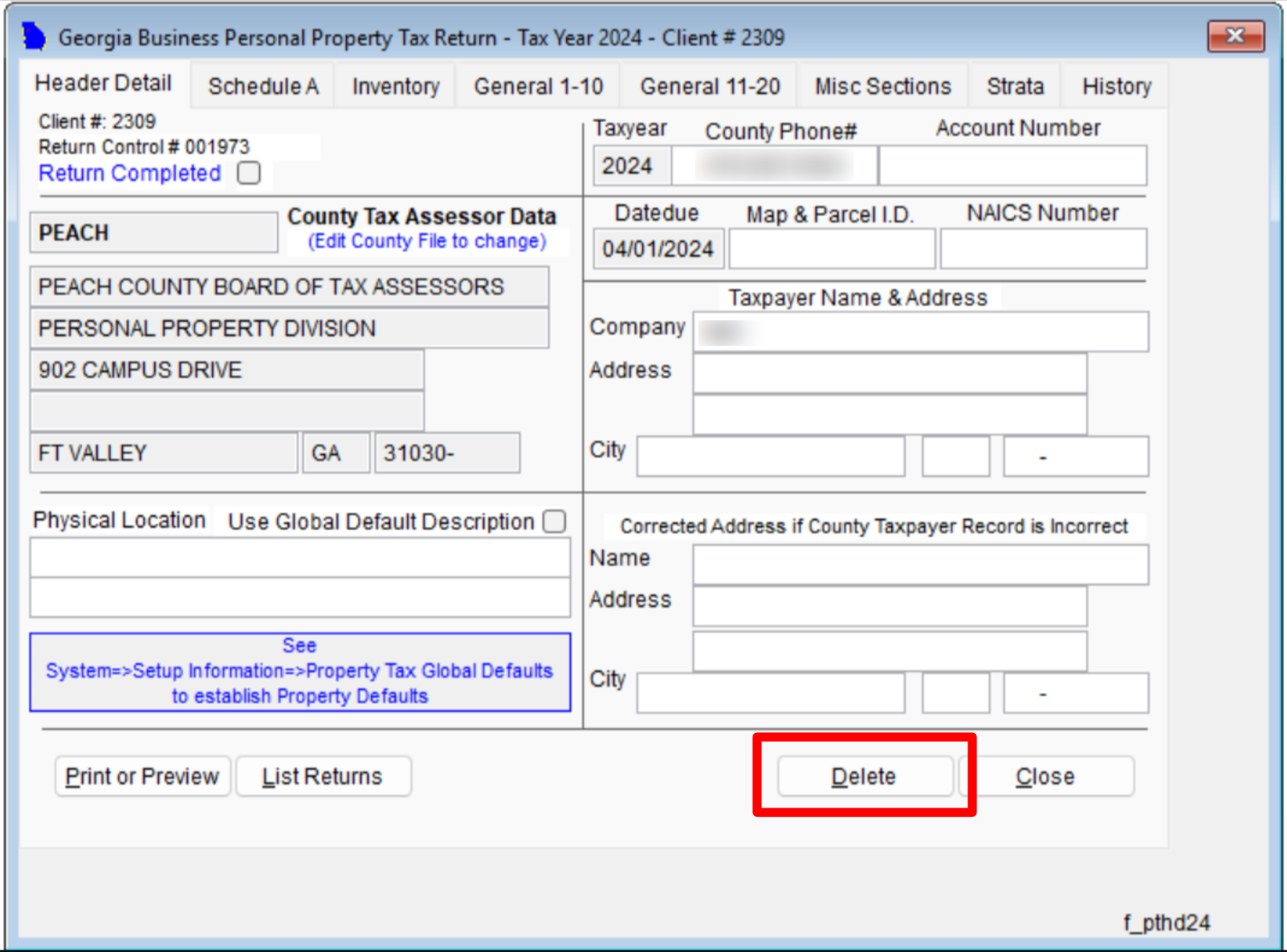

Open your return and click on the "Delete" button highlighted:

This button will change to "Undelete"

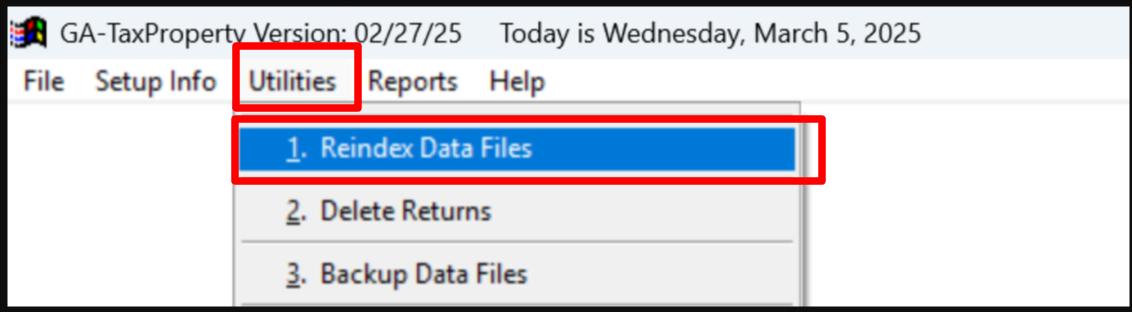

To complete the deletion process, go to the Utilities menu and select the "ReIndex" choice. Ensure that no other users are using the software during this operation, which only takes a few seconds to complete.

delete