How to Manually Roll Forward Past Property Returns

This guide assumes that you have already completed the batch rollover for the current year, and now you need to handle individual returns manually.

Let's say you have a 2023 return and you would like to roll it forward.

Steps to Manually Roll Forward a Past Return

Access Client Records

Navigate to Client Records and select List Clients.

Choose the client whose return you wish to roll forward.

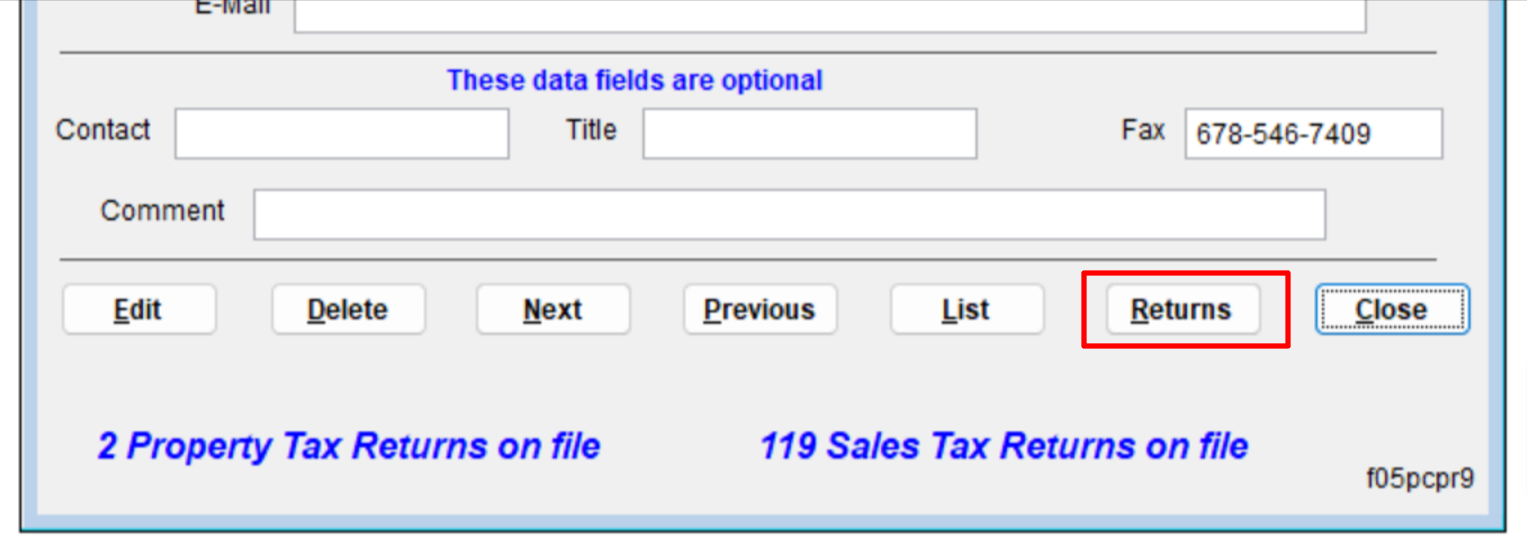

Select Returns

Click on the Returns associated with the selected client.

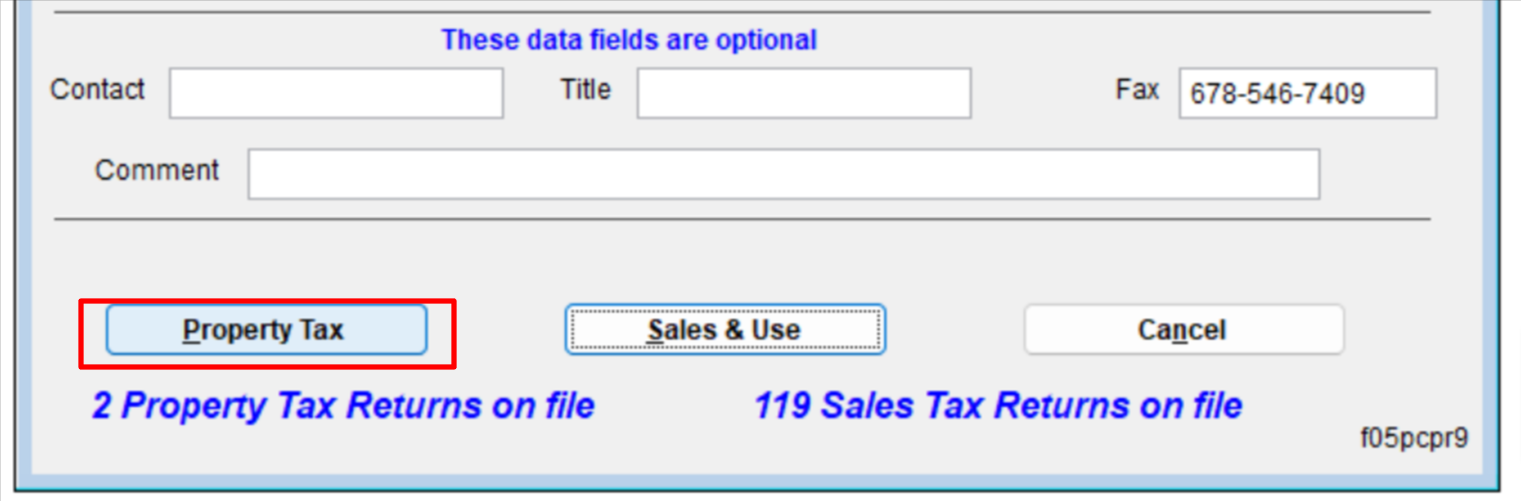

Choose Property Tax

Select Property Tax from the available options.

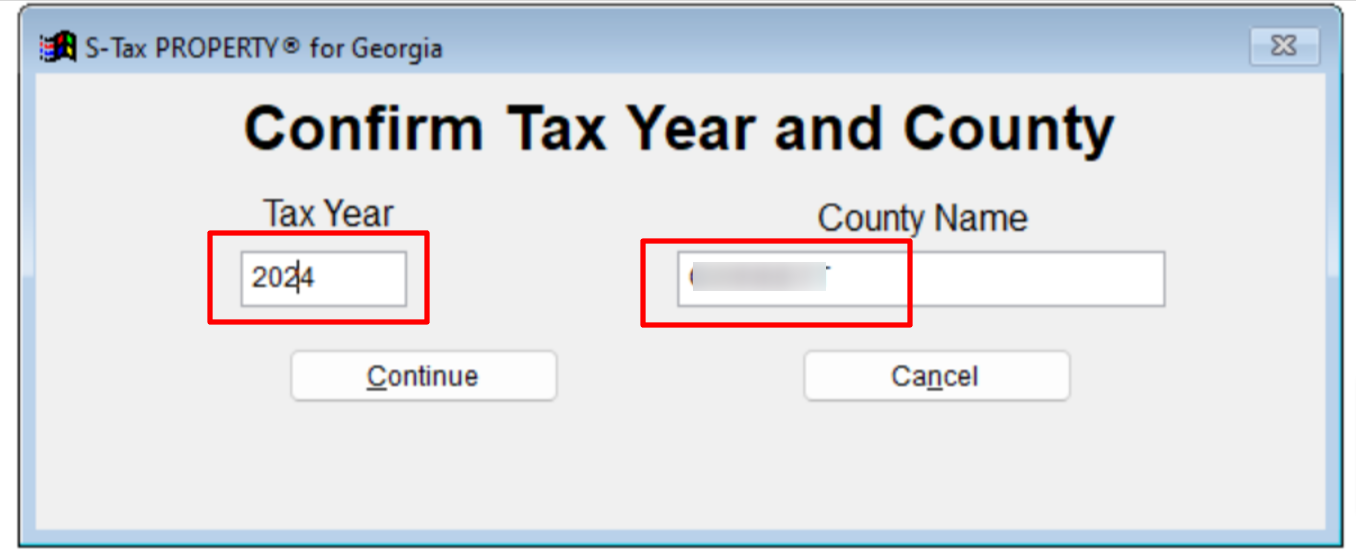

Change Tax Year

Update the tax year to 2024, ensuring you select the correct county name.

If you have already entered the 2023 return, the system should automatically roll forward relevant data to the 2024 return.

Repeat for Subsequent Years

Repeat the above step for the 2024 return, changing the tax year to 2025 to complete the process.