How to add a PT-50P for another county to an existing client?

Follow these steps to add a PT-50P for an additional county to an existing client.

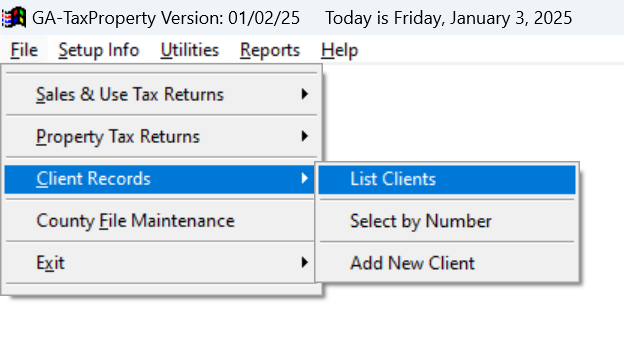

Navigate to Client Records and select List Clients.

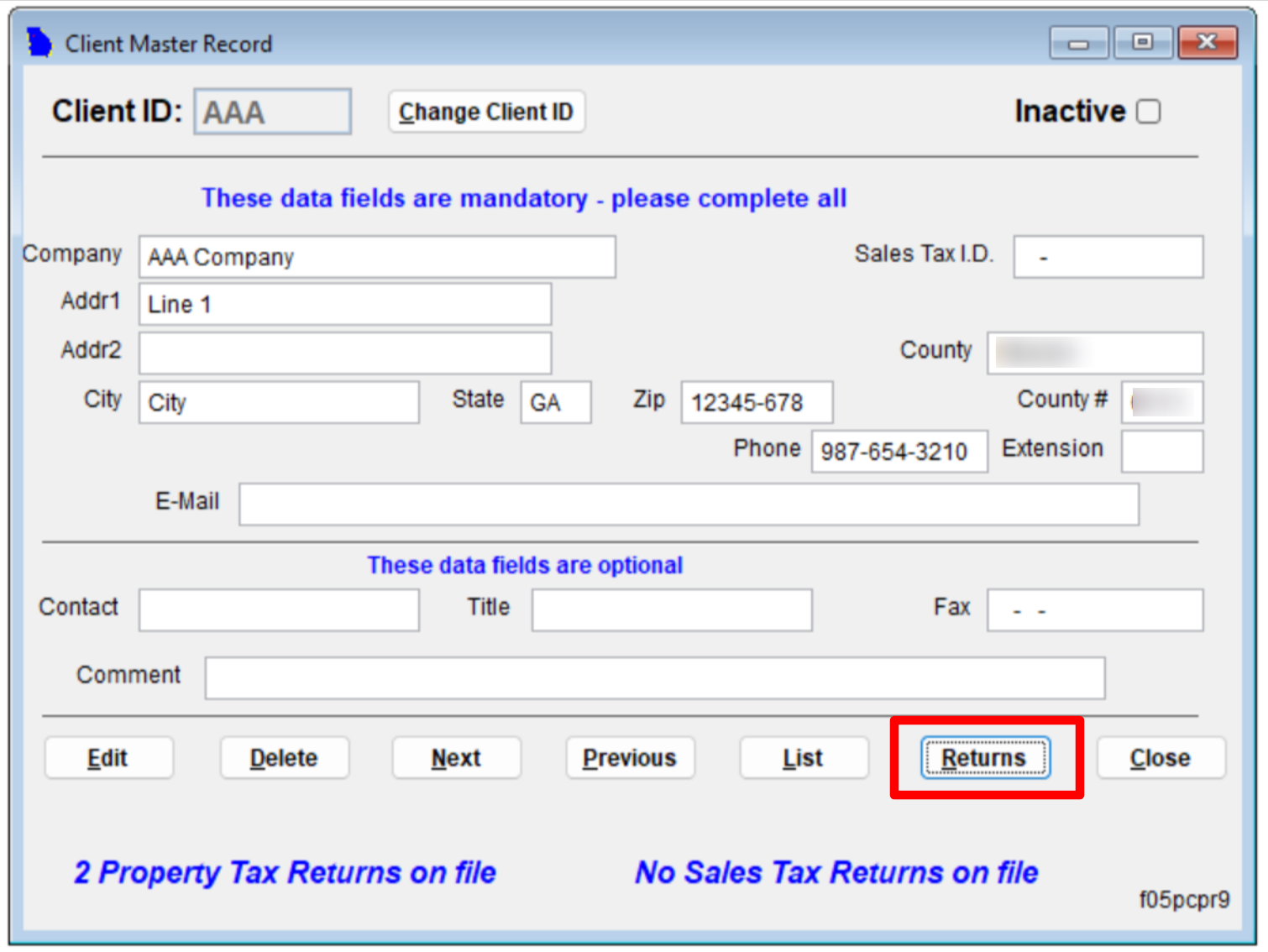

Choose the client to whom you want to add a PT-50P.

Click on Returns.

Enter the name of the new county for your return.

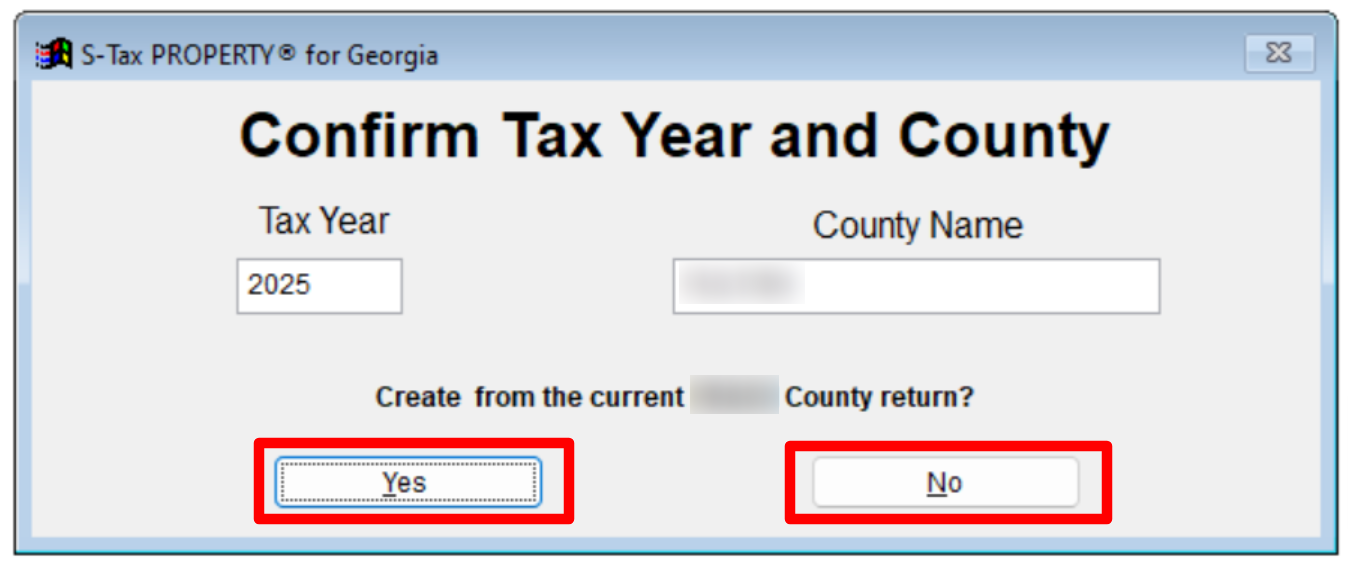

You will receive a prompt asking if you want to "Create from the current County return?"

If you select "No," a new PT-50P will be created for the client. Client information will be carried over without any prior Schedule A data.

If you select "Yes," a new PT-50P will be created for the client. Client information AND Schedule A will be carried over. This is useful if the client is transferring assets between counties.

After creating the new PT-50P, return to the main menu and navigate to Property Tax Return to edit the newly created PT-50P.