Create a Master Filer (Consolidated) Return

Please follow the following instructions to create a Master Filer.

Note: GTC will provide you with a Sales Tax ID that starts with "200" if Master Filer Return is required.

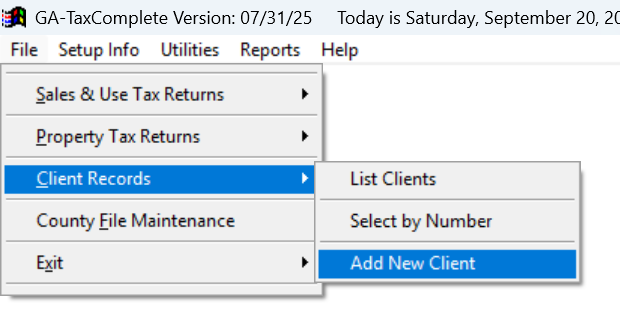

Step 1.

Go to File > Client Records > Add New Client

Enter a new Client ID

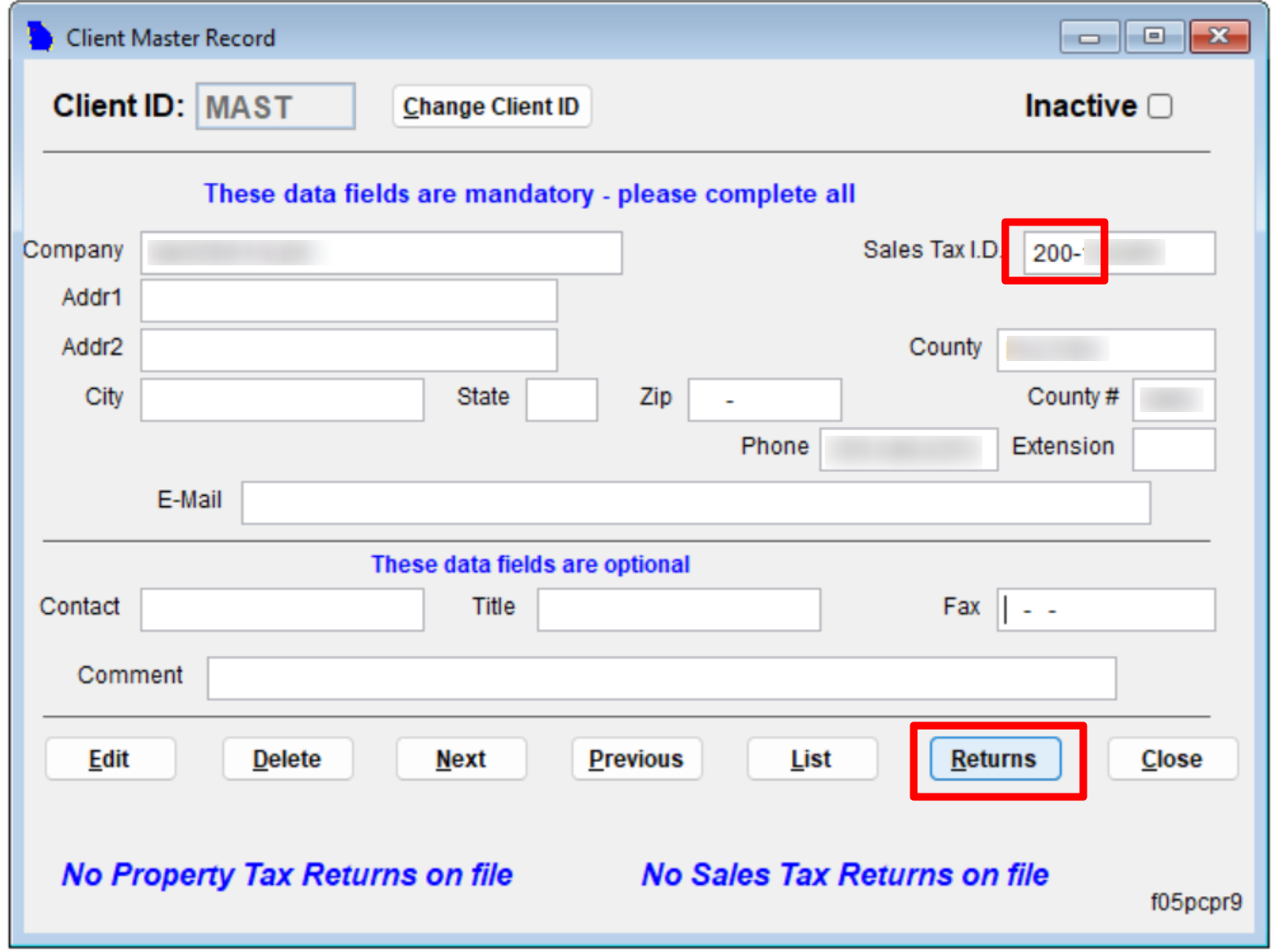

Step 2.

Fill in the below form.

Important: your Sales Tax ID will start with "200" to create a Master Filer

Click "Returns" button

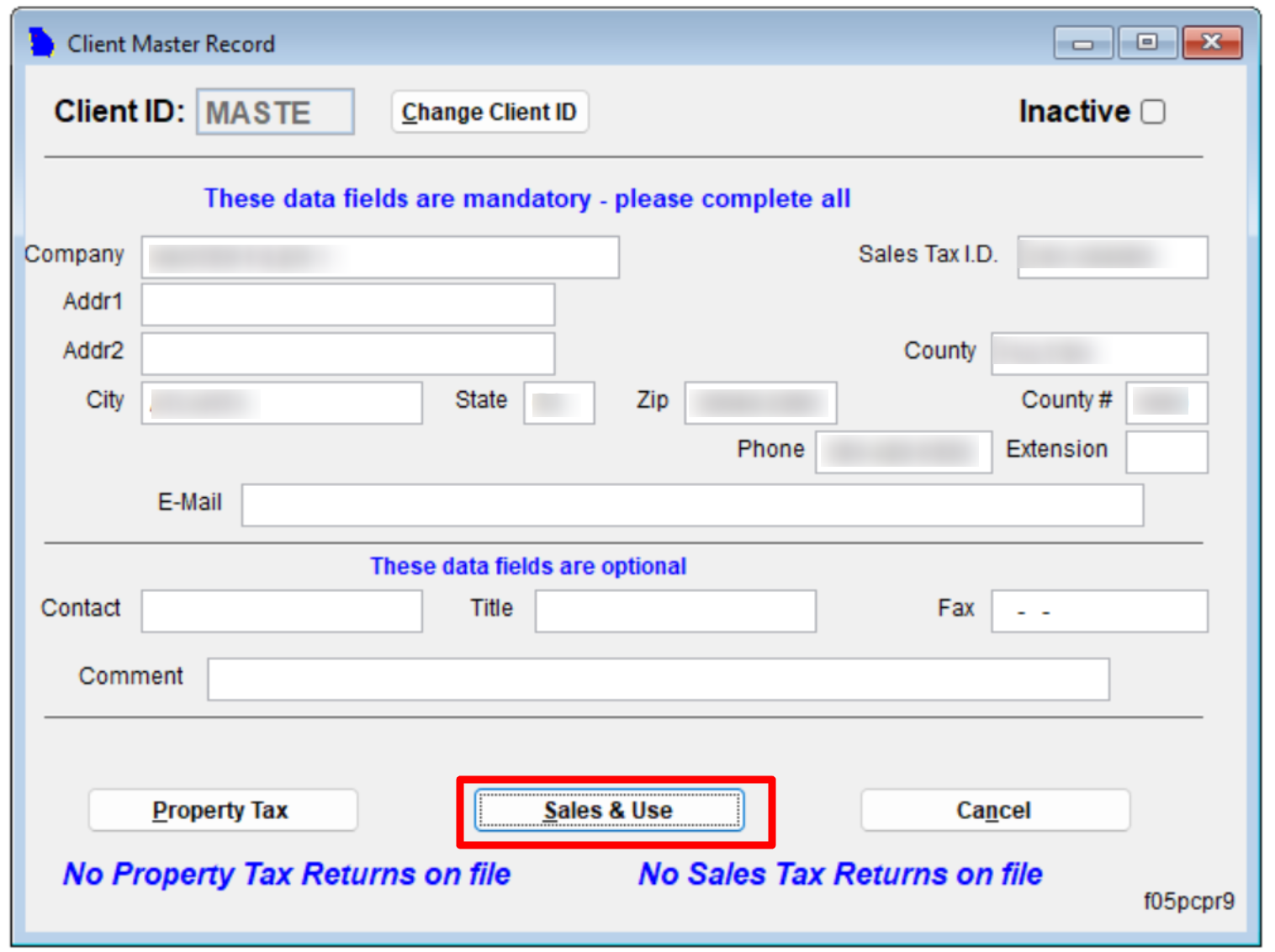

Step 3.

Select "Sales & Use" button

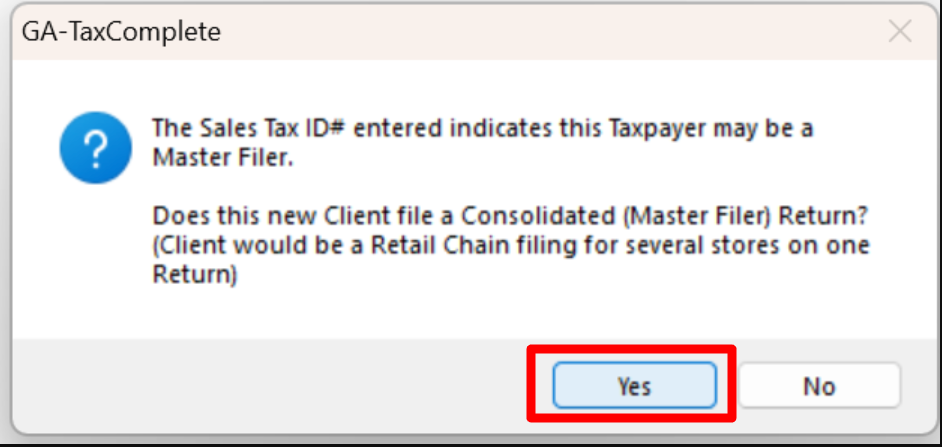

Select "Yes" when prompted if you are creating a Master Filer Return

You will not be prompted if your Sales ID does not start with "200"

Step 4.

Now we can add stores/locations:

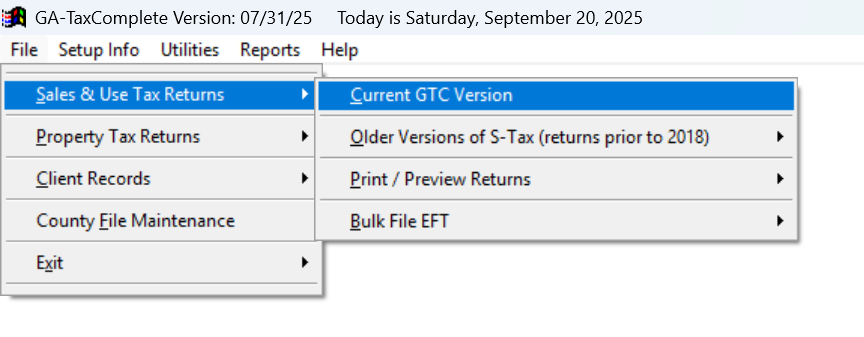

File > Sales & Use Tax Return > Current GTC Version

Select your client ID from the list

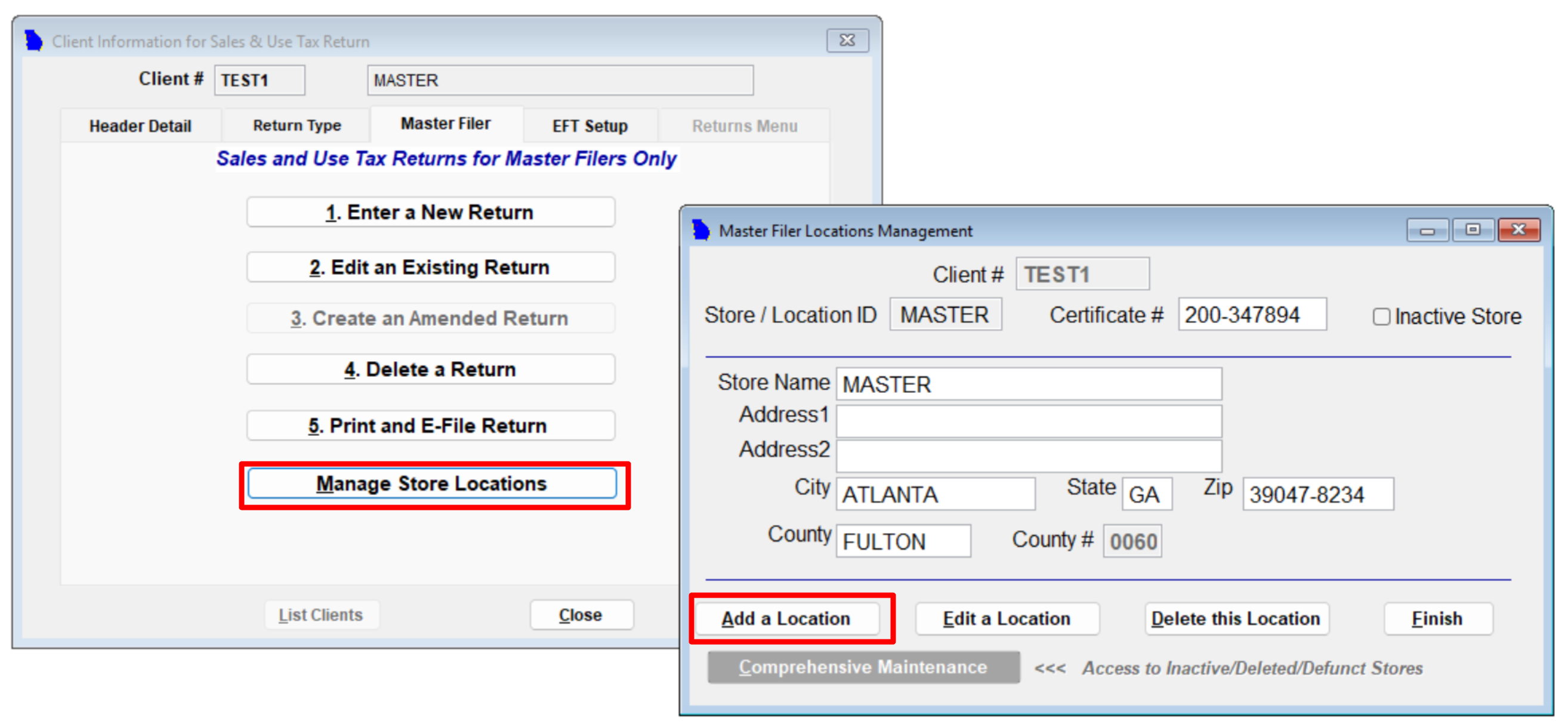

Step 5. Add a new location/store

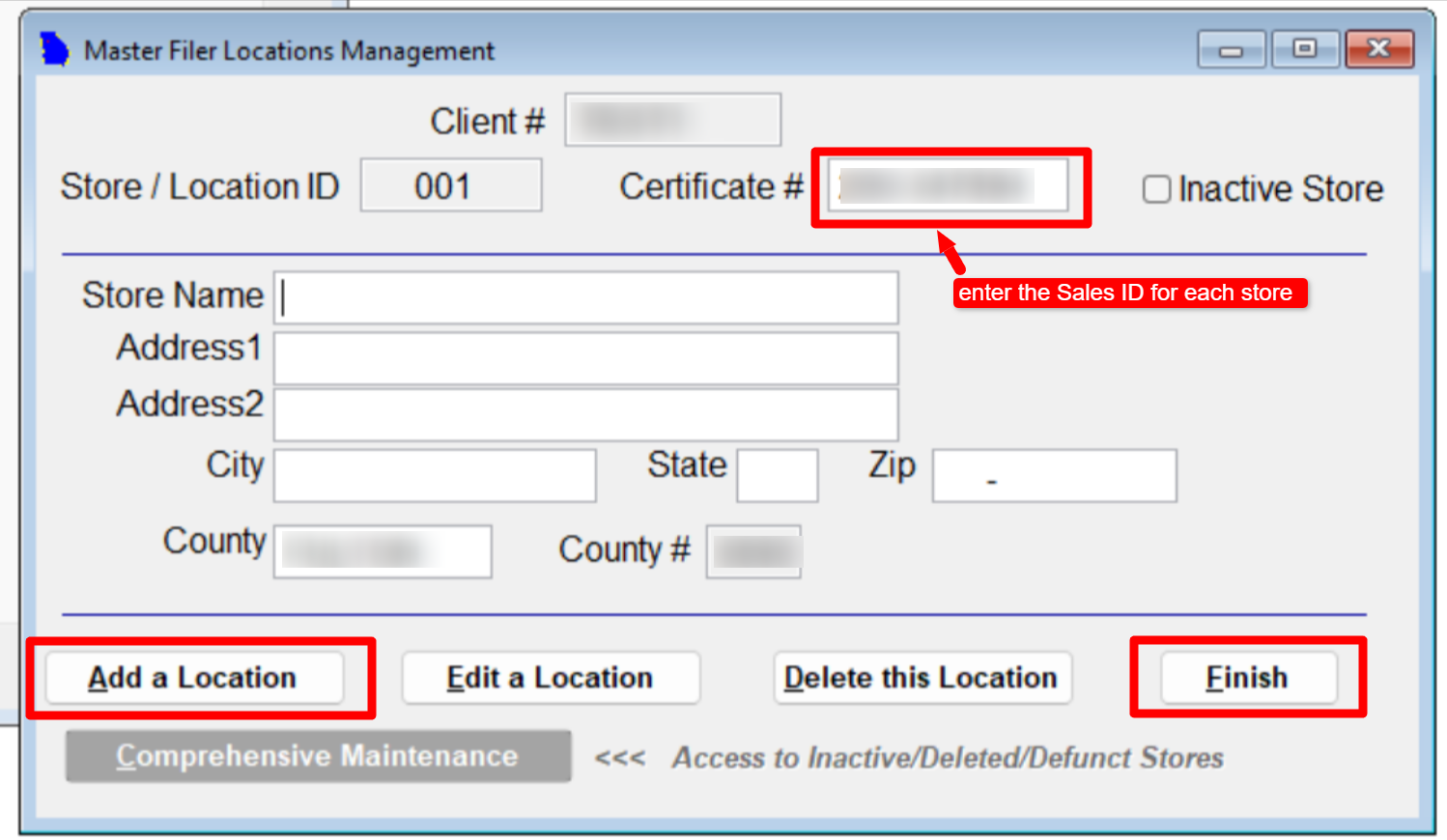

Click "Manage Store Locations", then "Add a Location"

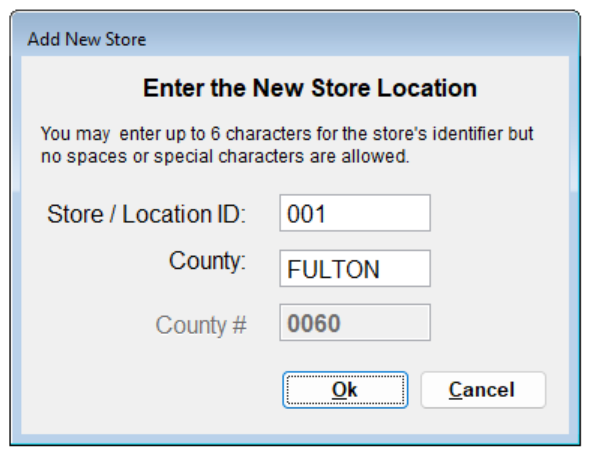

Step 6.

Enter a store ID and County

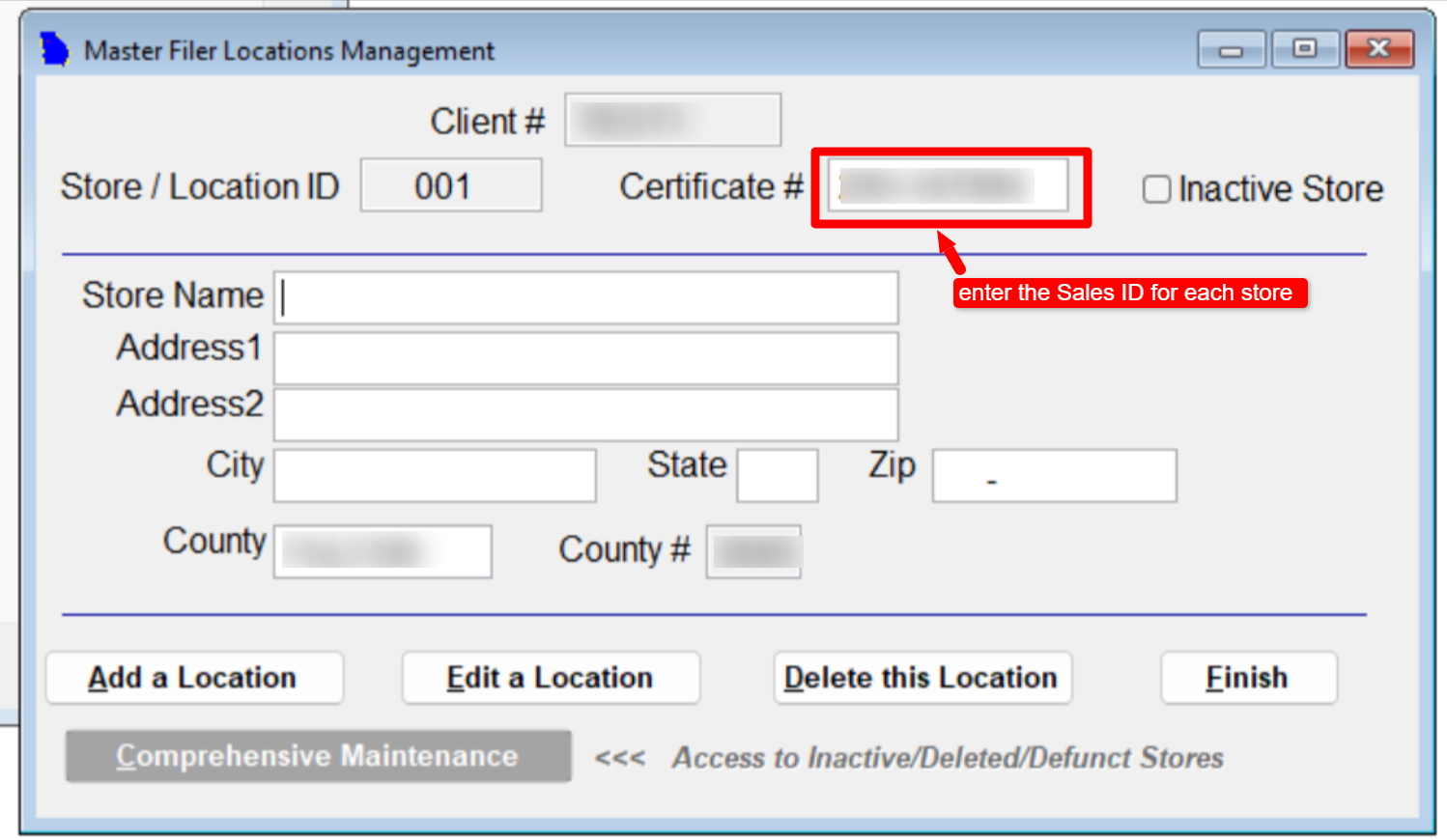

Step 7.

IMPORTANT: enter the certificate # (Sales ID) for the store. Each store will have its own Sales ID provided by GTC. You must enter this correctly

Fill in the other details (Store Name, Address, etc).

Click "Add a Location" to add a new store/location

Repeat step 5 to Step 7 until all locations are added.

Then click "Finish" when you are done adding all stores.

Step 8

When you are done adding all stores:

File > Sales & Use Tax Return > Current GTC Version. Select the client ID

You can then proceed to "Enter a New Return" to create a Sales & Use tax return as you normally would.