Lesson 2: Setting up new client details

To set up client details for the first time in GA-Taxpro, follow these steps:

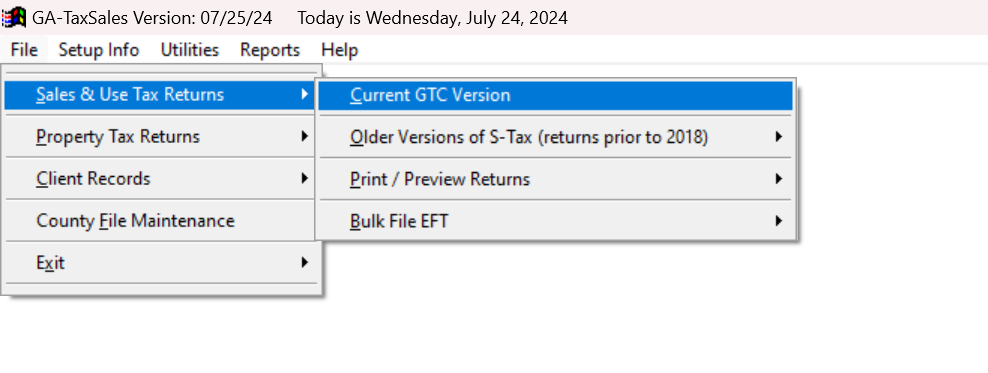

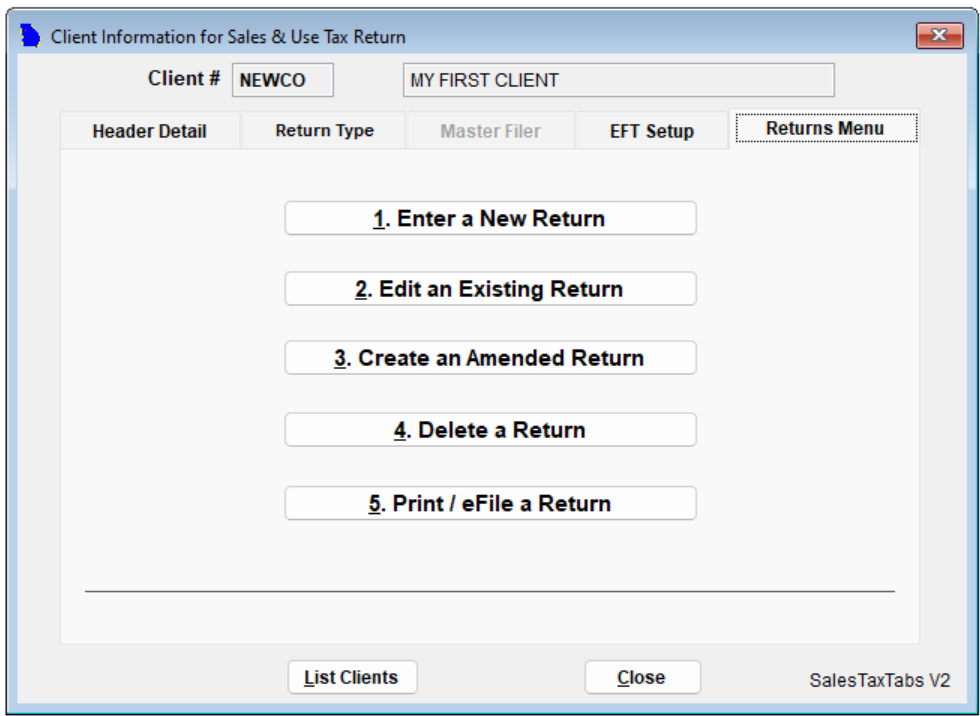

Step 1: In the main menu, click on "Sales & Use Tax Returns" and then select "Current GTC Version."

Step 2: Choose the client you want to work on from the list. If the client is not listed, refer to the "Add a new client" page for instructions on adding a new client.

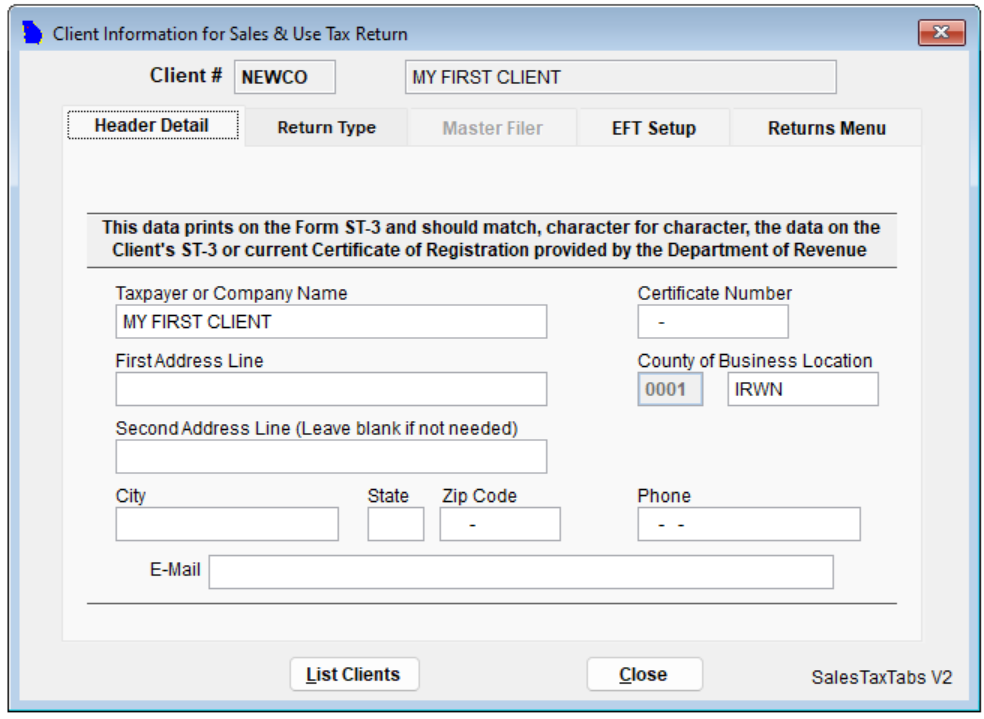

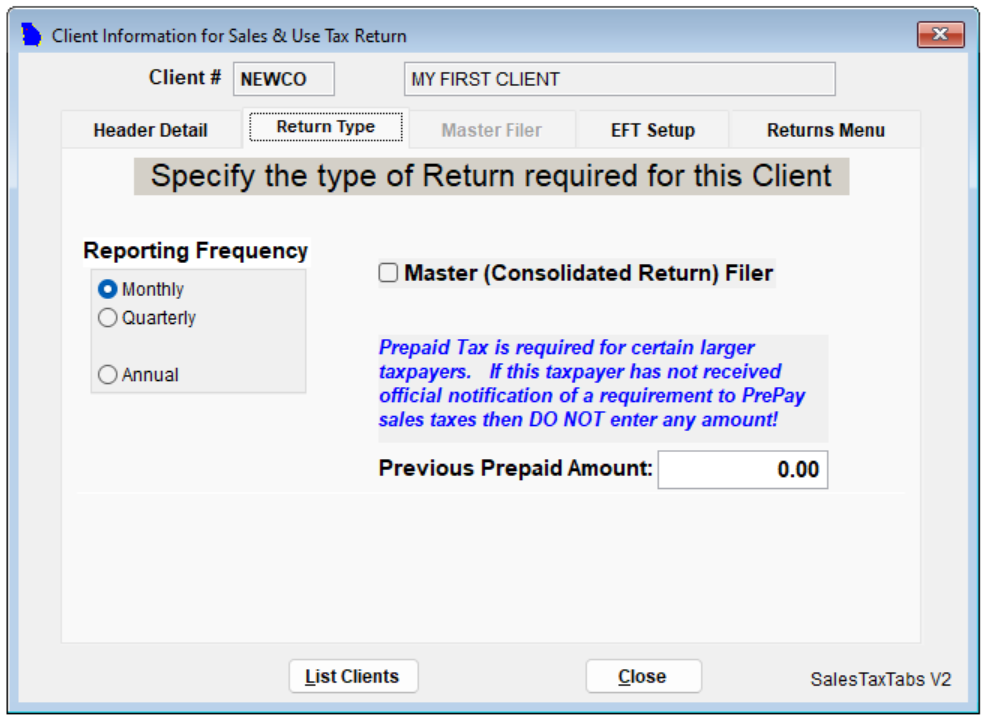

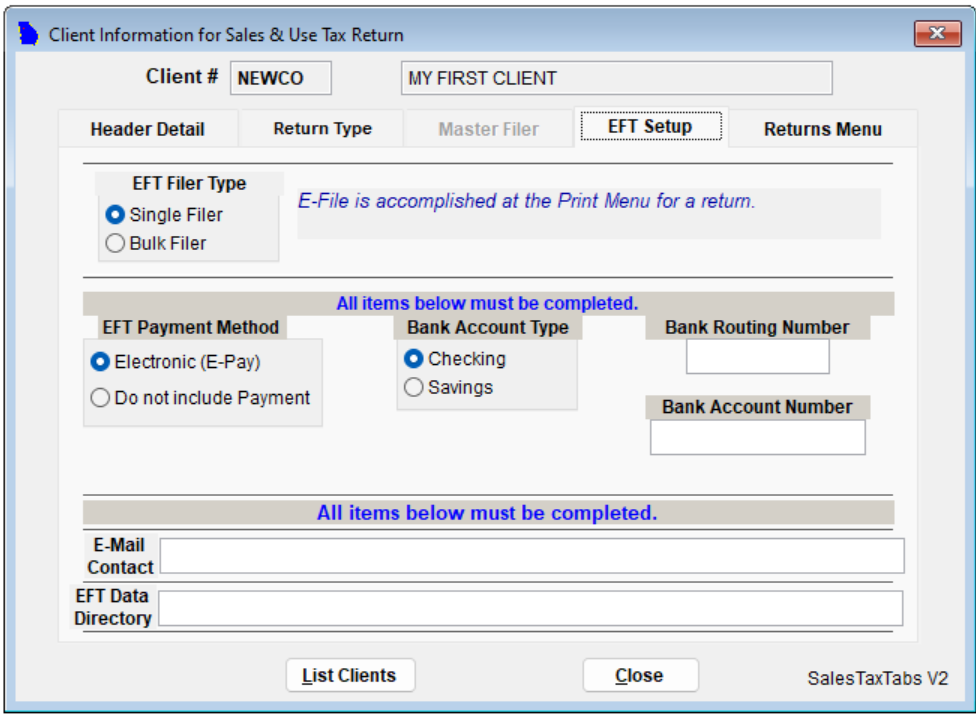

Step 3: Once you have selected the client, navigate through the following tabs to fill in the necessary information:

Header Details Tab: Fill in the header details exactly as you want them to appear on Form ST-3.

Return Type Tab: Select the appropriate return type for the client, either Monthly or Quarterly.

EFT Setup Tab: Input the client's EFT (Electronic Funds Transfer) details. If the client is part of bulk filing, make sure to select the "Bulk Filer" option here.

Step 4: After completing all the necessary tabs, click on "Enter a New Return" to proceed to the next section.

By following these steps, you will have successfully set up the client details for the first time in GA-Taxpro. This information will be used when generating Form ST-3 for the client.