Lesson 3: Adding a Sales & Use Tax return (ST-3)

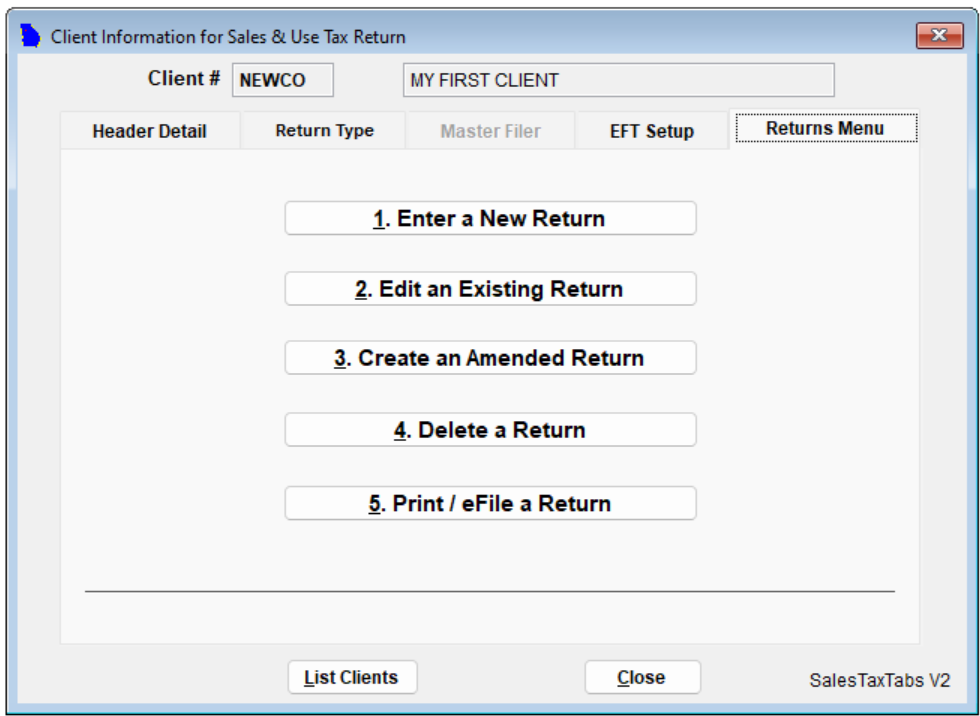

Step 1: In the Returns Menu tab, click "Enter a New Return"

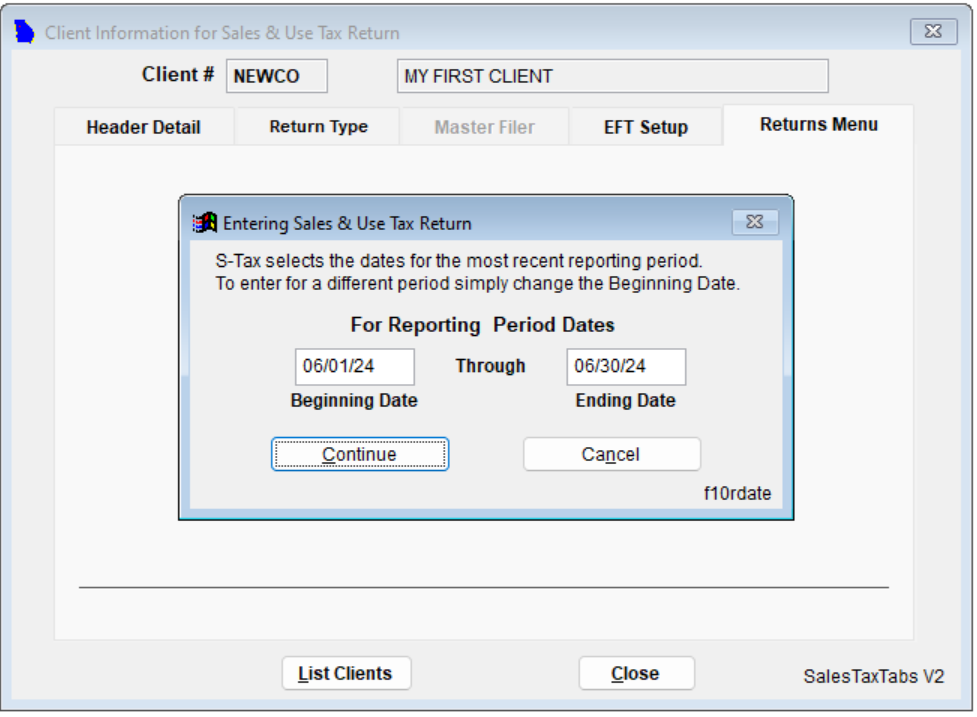

Step 2: Enter a reporting period. Hint: Enter a valid Beginning Date and the Ending Date will be populated accordingly. Click "Continue"

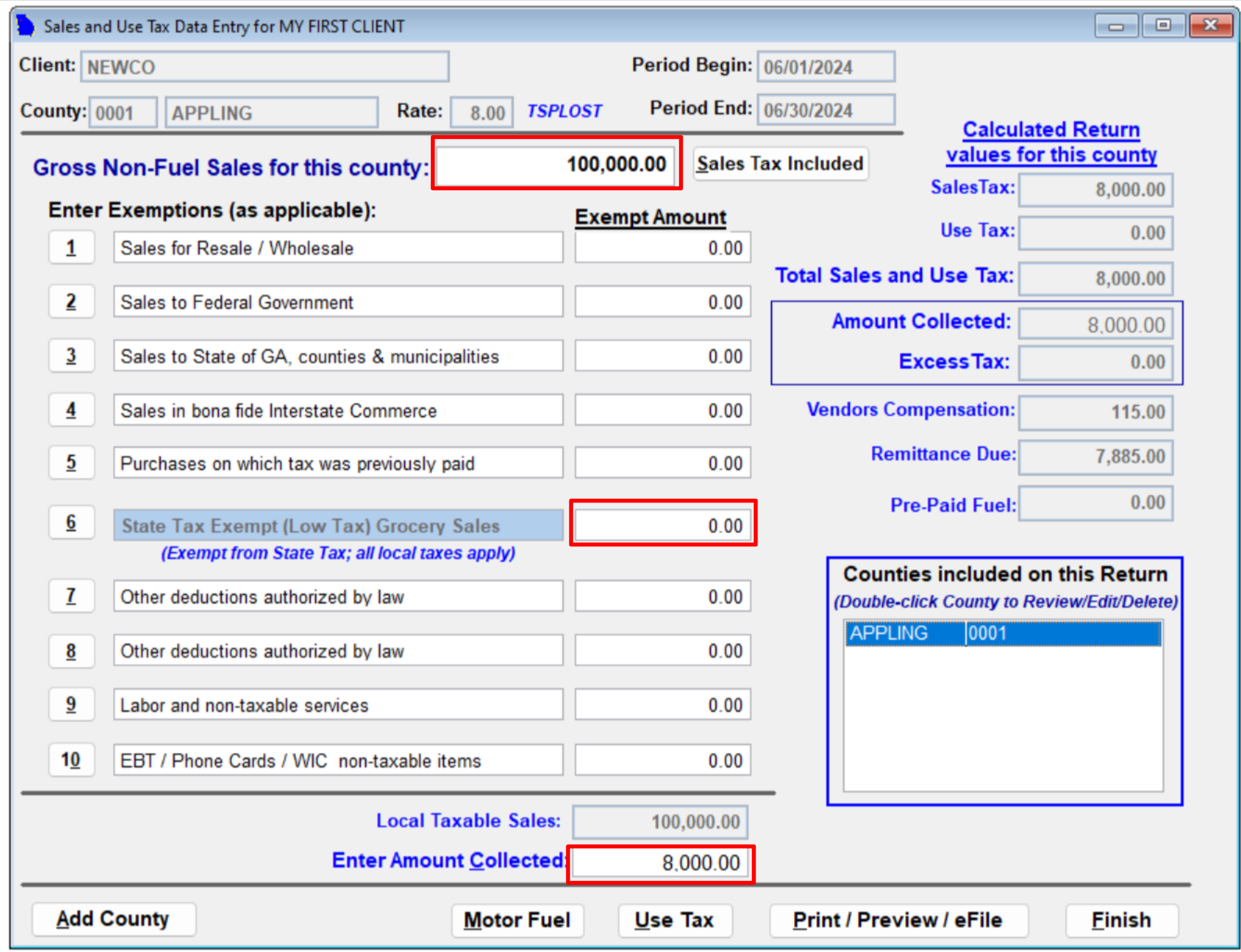

Step 3: You will now see the main data entry form.

Check that you are entering data for the correct county. If not, select the correct county in the bottom right table. You can add a new county by clicking on the "Add County" button in the bottom left corner.

For a valid return, you should fill in the following fields:

"Gross Non-Fuel Sales for this county"

"Sales Tax Exempt (Low Tax) Grocery Sales"

"Enter Amount Collected": Enter the total tax collected (from account records)

You can use 7 and 8 for other customized deductions

Step 4: Click "Finish" to complete the data entry process.

Next: Learn how to Print, Preview, or eFile your return in the next section.