Bulk File EFT

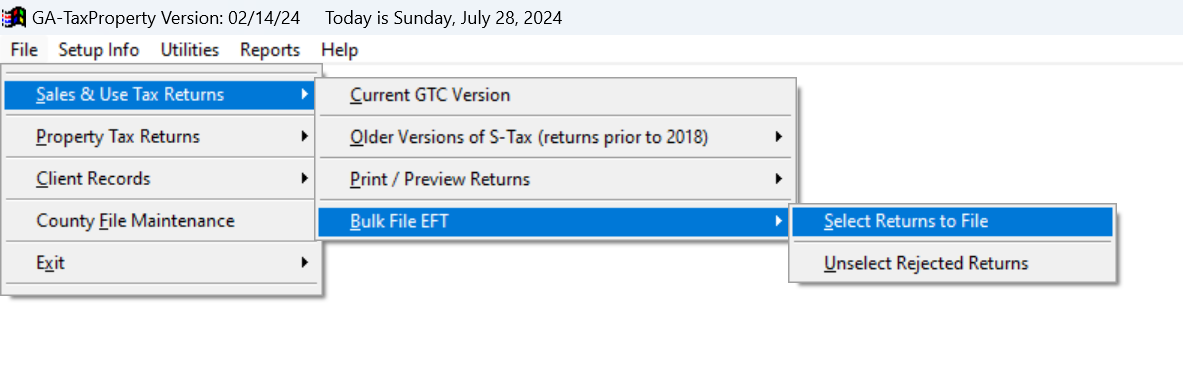

Step 1: Navigate to Sales & Use Tax Returns

Click on the "Sales & Use Tax Returns" in the main menu.

Select "Bulk File EFT" from the dropdown menu.

Click on "Select Returns to File."

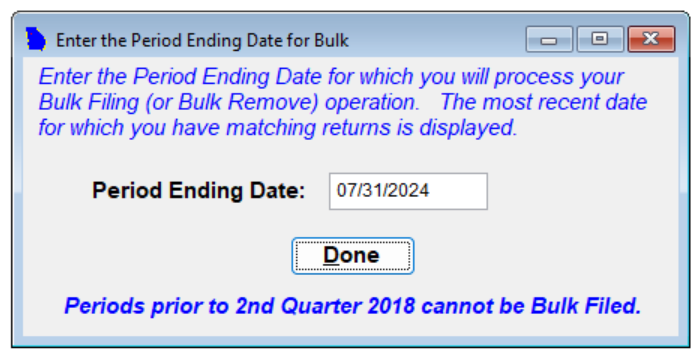

Step 2: Enter the Period Ending Date

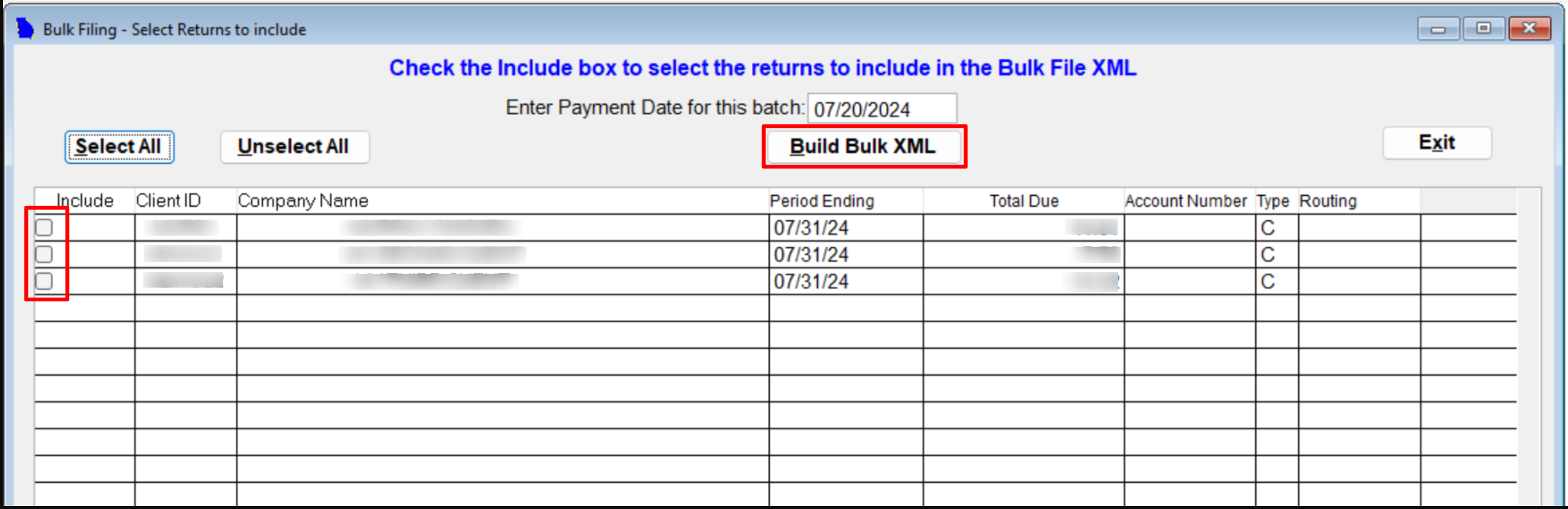

Step 3: Select Returns for Bulk Filing

In the "Select Returns to Include" window, you will see a list of clients eligible for bulk filing.

Select the checkboxes next to the clients you want to include in the XML for bulk filing.

If a client is missing from the list, ensure that they are classified as a "Bulk Filer" in the EFT Setup Tab. (For more information, see: "How to Change a return from Single Filer to Bulk Filer" tutorial)

Click the "Build Bulk XML" button to proceed.

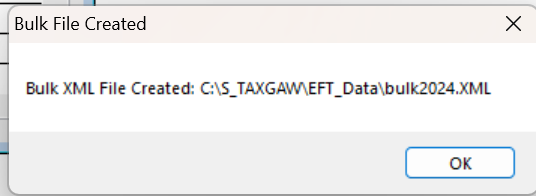

Step 4: Save the Bulk XML File

After clicking "Build Bulk XML," a confirmation window will appear.

Click "OK" to create the bulk file in XML format.

The XML file will be saved in the directory shown in the confirmation window.

You can now upload this XML file to GTC for processing.

Step 5: Generate a Bulk File Report (Optional)

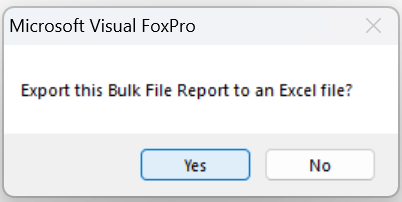

After saving the XML file, a prompt will ask if you want to generate a Bulk File Report in Excel format.

Select "Yes" to create the report, which will be saved in your application folder (typically C:/S_TaxGAw).

This report contains a list of clients included in your XML file for your internal records.

You have now successfully completed the process of Bulk Filing EFT in GA-TaxPro.