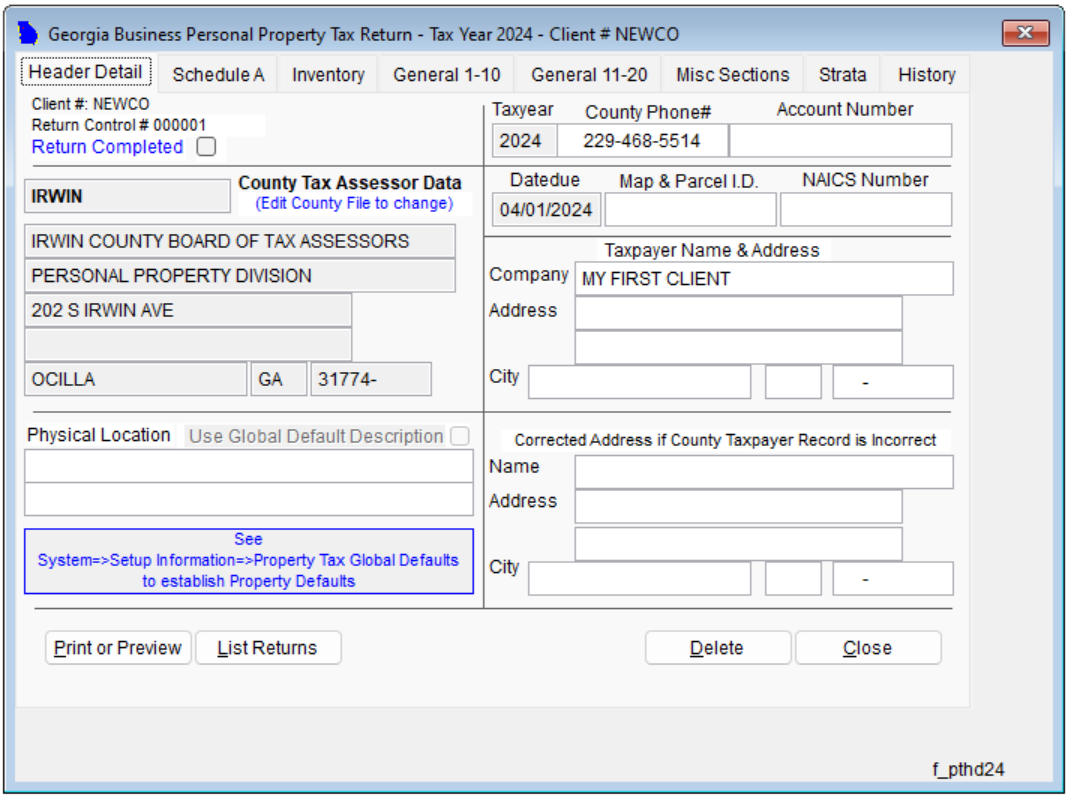

Lesson 4: Completing the Header Details

Edited

Select the client

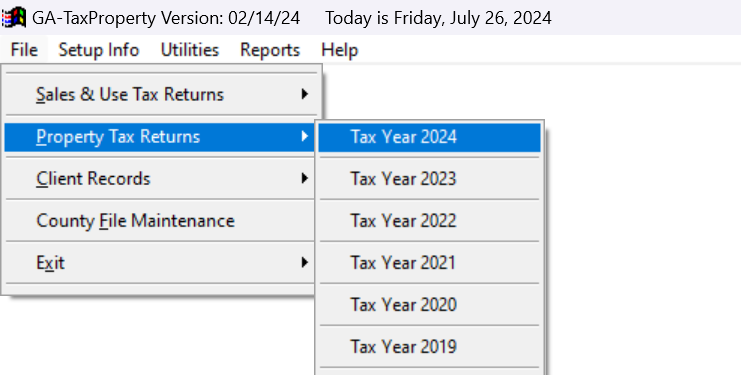

Go to File > Property Tax Return > Tax Year [2024] (select the current tax year).

From the client list, select the client you want to work on.

The following will walk you through the various sections of PT-50P accordingly.

Complete the Header Detail Tab

Review and update the header details, such as the taxpayer's name, address, and contact information.

Ensure that all the information is accurate and up-to-date.

Next: Schedule A