Lesson 3: Roll Forward Return for an EXISTING CLIENT

In this tutorial, we will guide you through the process of rolling forward/adding a Personal Property Tax Return for an EXISTING tax return in GA-TaxPro. If you are working with a new client, please refer to "Lesson 2: Adding a NEW client" article.

Step 1: Select the client

Go to File > Property Tax Return > Tax Year 2024 (select the current tax year).

Step 2: Roll forward the return

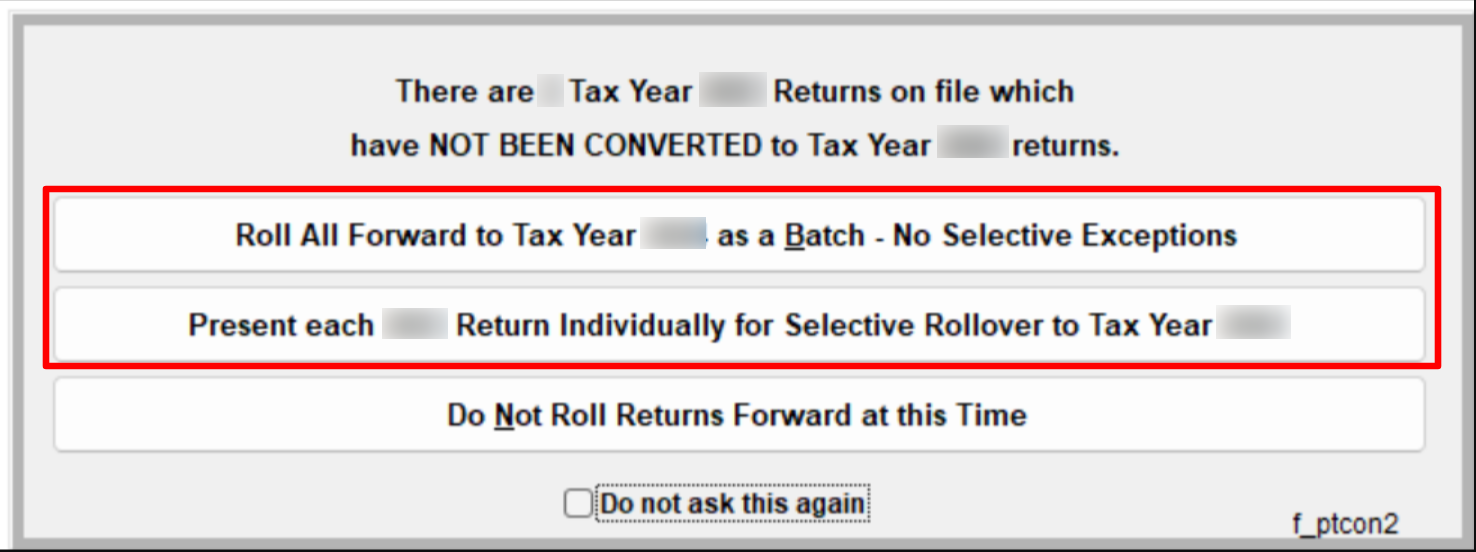

When GA-TaxPro detects an existing return from the previous year, you will see a prompt asking if you want to roll forward the return to the current year.

In the below example, it will check if there is a past return for Tax Year 2023 and prompt you to roll it forward to Tax Year 2024.

You can choose to roll all existing clients as a batch or scroll through each active client individually and choose which one you want to rollover to the current tax year.

(optional) you can check 'Do not ask this again' if you want to disable this prompt (you can re-enable this prompt by going to Setup Info > Property Tax Global Defaults > Enable roll forward prompt; see Lesson 1)

Step 3: Confirm successful rollover

Upon successful rollover, you will see a success prompt.

You will then be presented with a list of existing returns that have been rolled forward and are available for you.

Step 4: Select the return and proceed

Select the client you want to work on from the list of rolled-over clients.

All rolled forward return will have General Information 1-20, header details and Schedule A pre-filled to save you time.

Next: Header Details